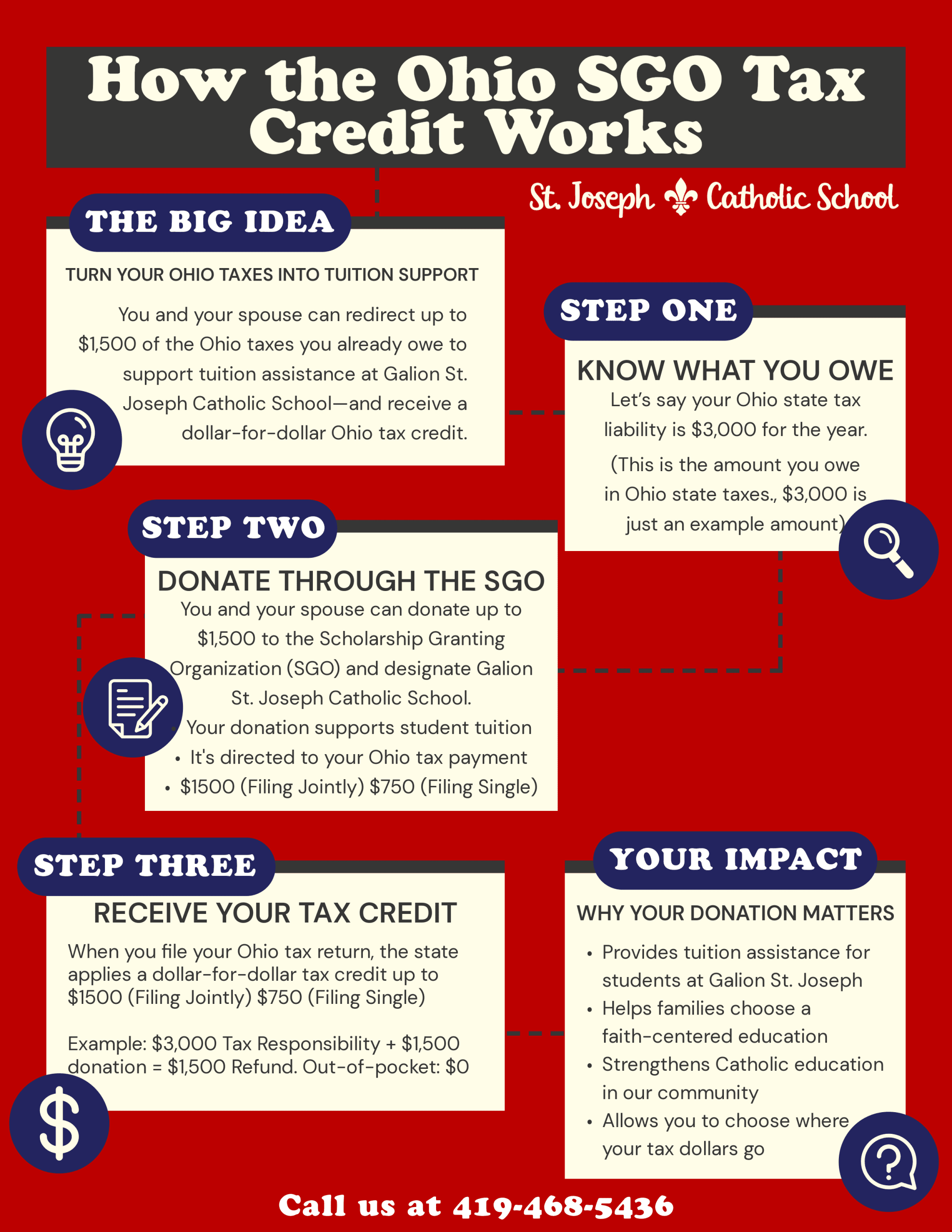

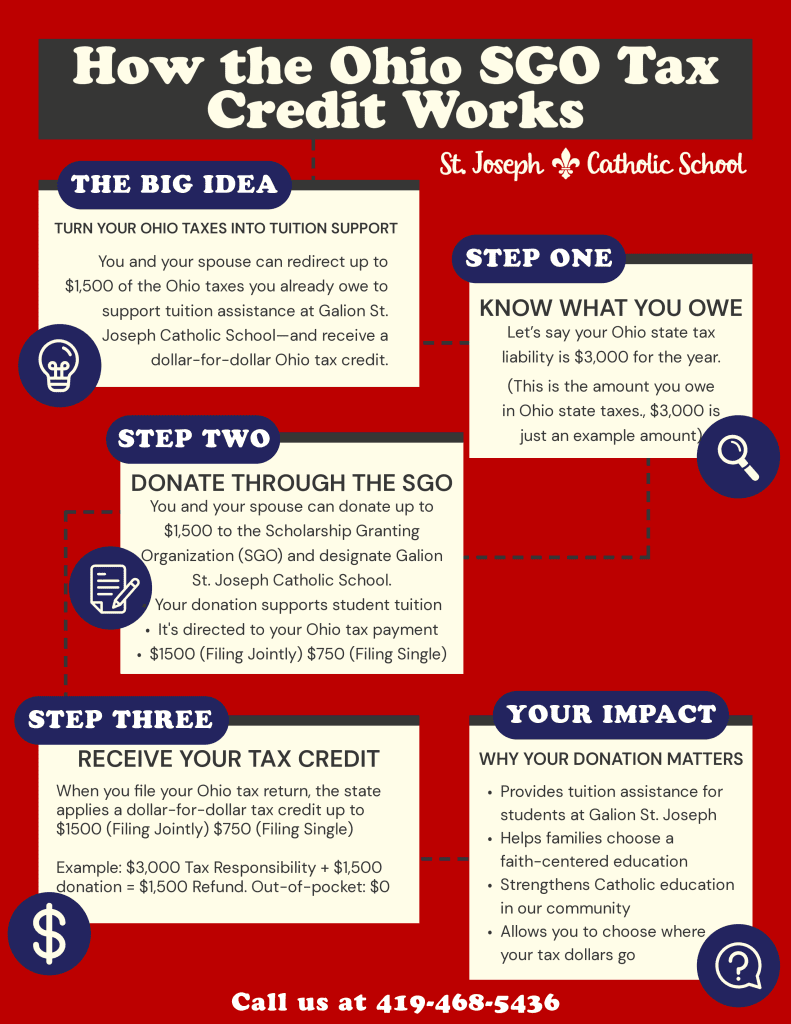

Redirect Your Ohio State Taxes to Support Local Students

Did you know you can support St. Joseph Catholic School in Galion, Ohio using your Ohio state tax dollars — at no additional cost to you?

Through the Ohio Scholarship Granting Organization (SGO) Tax Credit Program, taxpayers can make a donation to an approved Scholarship Granting Organization and receive a dollar-for-dollar tax credit on their Ohio state income tax liability.

That means your donation directly supports Catholic education while reducing what you owe to the State of Ohio.

How the Ohio SGO Tax Credit Works

If you owe Ohio state income taxes, you can:

- Donate up to $750 (individual filers)

- Donate up to $1,500 (married filing jointly)

Your donation qualifies for a 100% dollar-for-dollar credit on your Ohio tax return.

Instead of sending that portion of your taxes to the state’s general fund, you can choose to direct it toward scholarships that help students attend St. Joseph Catholic School.

Why Your Support Matters

Contributions to the SGO Fund provide tuition assistance to families who desire a faith-centered Catholic education for their children.

Your participation:

- Expands access to Catholic education

- Supports local students in Galion and Crawford County

- Strengthens our parish and school community

- Makes a lasting impact on the next generation

It’s a simple way to invest in students, families, and the future of our community.

Take Action Today

If you are filing Ohio state taxes, consider directing part of your tax liability to support scholarships at St. Joseph Catholic School.

📞 Contact the school office with questions – 419-468-5436

🌐 Visit sjsaints.org to learn more about how to participate

Choose where your tax dollars go.

Support Catholic education.

Make a meaningful difference.